AI Retirement Planner

Experience a revolutionary approach to retirement planning with AI-powered insights. Our cutting-edge AI retirement planner combines extensive financial knowledge with advanced algorithms to provide personalized guidance, helping you craft a comprehensive strategy for your ideal retirement.

AI-Driven Retirement Planning

Kaight’s AI retirement planner goes beyond basic calculations to help you develop a personalized retirement strategies. Our intelligent assistant analyzes your financial situation, goals, and risk tolerance to create a tailored plan that evolves with you. Explore various retirement scenarios, receive ongoing advice, and adjust your strategy as your life changes. Don’t worry if you’re unsure about some aspects of your finances – Kaight will guide you through the planning process, offering educated estimates where needed and highlighting areas for further exploration.

Core Capabilities

AI-Powered Consultation

- Engage in deep financial discussions

- Receive personalized advice

Holistic Financial Analysis

- Evaluate all aspects of your finances

- Consider long-term economic trends

Adaptive Planning Tools

- Adjust plans as life changes

- AI suggests plan modifications

Advanced Scenario Modeling

- Test multiple retirement strategies

- Analyze impact of major life events

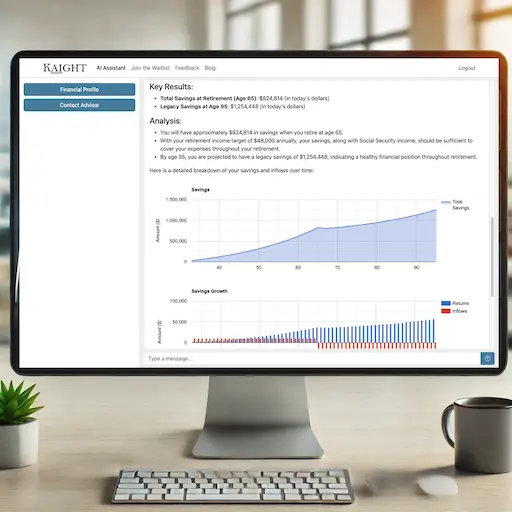

Dynamic Visualizations

- Interactive financial projections

- Visual comparison of strategies

Continuous Learning & Optimization

- AI adapts to market changes

- Ongoing strategy refinement

The Planning Process

- Engage in an in-depth financial discussion with our AI

- Provide comprehensive financial data and goals

- Receive a detailed retirement strategy analysis

- Explore various retirement scenarios and outcomes

- Get personalized recommendations for optimization

- Implement suggested changes to your strategy

- Regularly review and adjust your plan with AI insights

Benefits of AI Retirement Planning

- Leverages advanced financial algorithms

- Considers complex market dynamics

- Adapts to changing life circumstances

- Provides data-driven strategy recommendations

- Saves time through automated analysis

- Enhances long-term financial security

The Evolution of Retirement Planning

Retirement planning has come a long way from simple savings accounts and pensions. Today, with the power of AI, we’re entering a new era of sophisticated, personalized retirement strategies. Here’s how AI is revolutionizing retirement planning:

1. Personalized Risk Assessment

AI analyzes your unique financial situation and risk tolerance to create a tailored investment strategy that balances growth potential with your comfort level.

2. Dynamic Strategy Adjustment

Unlike static plans, AI-driven strategies can adapt to market changes and shifts in your personal circumstances, ensuring your plan remains optimal.

3. Comprehensive Scenario Analysis

AI can rapidly model countless retirement scenarios, helping you understand the potential outcomes of different decisions and life events.

4. Intelligent Drawdown Strategies

AI can optimize your retirement income drawdown, considering tax implications, market conditions, and your changing needs throughout retirement.

5. Behavioral Finance Insights

AI can identify and help mitigate behavioral biases that might negatively impact your financial decisions, promoting more rational planning.

6. Holistic Financial View

AI can integrate all aspects of your financial life – from investments and insurance to estate planning and charitable giving – into a cohesive retirement strategy.

7. Continuous Learning and Improvement

AI systems continually learn from new data and research, ensuring your retirement plan benefits from the latest financial insights and strategies.

With Kaight’s AI-powered retirement planner, you can harness these advanced capabilities to create a robust, flexible retirement strategy. Our cutting-edge tools and personalized insights make it easier than ever to navigate the complexities of modern retirement planning and achieve your long-term financial goals.