Next-Gen AI Retirement Calculator

Discover a smarter way to build wealth with the power of AI. Our pioneering AI retirement calculator combines vast knowledge and advanced algorithms with intuitive conversation and sage guidence to to help you navigate to a better financial future.

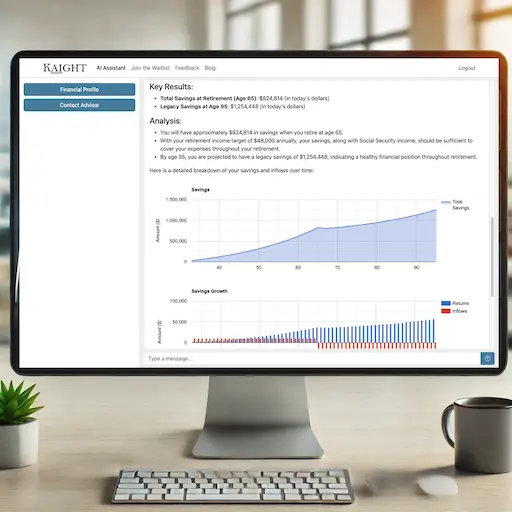

AI Enhanced Retirement Calculator

Instantly project your retirement income based on your current financial situation with Kaight. Our AI assistant goes far beyond standard calculations, incorporating advanced analysis and personalized recommendations. Easily tweak your plan and run multiple scenarios to determine the optimal path to financial freedom. Don’t worry if you’re missing some data – Kaight will guide you through the process, coaching you on what information is needed and even filling in gaps with smart assumptions.

With Kaight, you’re not just calculating numbers; you’re crafting a comprehensive, flexible retirement strategy tailored to your unique circumstances.

Key Features

Conversational Interface

- Chat naturally with our AI

- No complex forms needed

Comprehensive Analysis

- Multiple income sources

- Inflation and investment returns

Flexible Input Options

- Guided chat or detailed form

- AI fills in knowledge gaps

Dynamic Scenario Planning

- Easily adjust variables

- Compare multiple scenarios

Visual Insights

- Interactive charts

- Visualize financial decisions

AI-Driven Recommendations

- Personalized insights

- Actionable advice

How It Works

- Start a conversation with our AI

- Input your data through chat or form

- Receive instant calculations

- Review projected savings and income

- Explore different scenarios

- Get AI-generated insights

- Ask deeper questions about your plan

Why Choose Our Calculator?

- Personalized to your situation

- Comprehensive factor consideration

- Flexible for changing circumstances

- Intelligent, AI-driven insights

- User-friendly for all skill levels

- Empowering for informed decisions

The Importance of Retirement Planning

Planning for retirement is one of the most crucial financial steps you can take in your life. It’s not just about saving money; it’s about securing your future and ensuring you can maintain your desired lifestyle when you’re no longer working. Here’s why retirement planning is so important:

1. Financial Security

A well-planned retirement can provide you with the financial security to enjoy your golden years without worrying about making ends meet. It allows you to maintain your independence and gives you the freedom to pursue your passions.

2. Longer Life Expectancies

With advancements in healthcare, people are living longer than ever before. This means your retirement savings need to last longer too. Proper planning ensures you won’t outlive your savings.

3. Rising Healthcare Costs

Healthcare costs tend to increase as we age. A solid retirement plan takes these potential expenses into account, helping you avoid financial strain due to medical bills.

4. Uncertain Future of Social Security

While Social Security provides a safety net, its future is uncertain. Relying solely on these benefits may not be sufficient. A personal retirement plan gives you more control over your financial future.

5. Power of Compound Interest

The earlier you start planning and saving for retirement, the more you can benefit from compound interest. Even small contributions can grow significantly over time.

6. Tax Benefits

Many retirement savings vehicles offer tax advantages. Proper planning can help you maximize these benefits and potentially reduce your tax burden.

7. Peace of Mind

Knowing that you have a solid retirement plan in place can reduce stress and anxiety about the future. It allows you to focus on enjoying life, both now and in retirement.

With Kaight’s AI-powered retirement calculator, you can start your journey towards a secure retirement today. Our advanced tools and personalized insights make it easier than ever to create a comprehensive retirement plan tailored to your unique needs and goals.